A Super Useful Budgeting Tool for the Budgeting Geeks!

Disclaimer: I have been provided a copy of PocketSmith so that I can trial it, and review it based on my experiences - positive or not. All the words below are from my mouth/fingers and aren't influenced by PocketSmith 🙂

For the last month or two, I've been having a play with a budgeting tool - PocketSmith. And one thing that this has, that many others don't, is that it is created in NZ 🙂

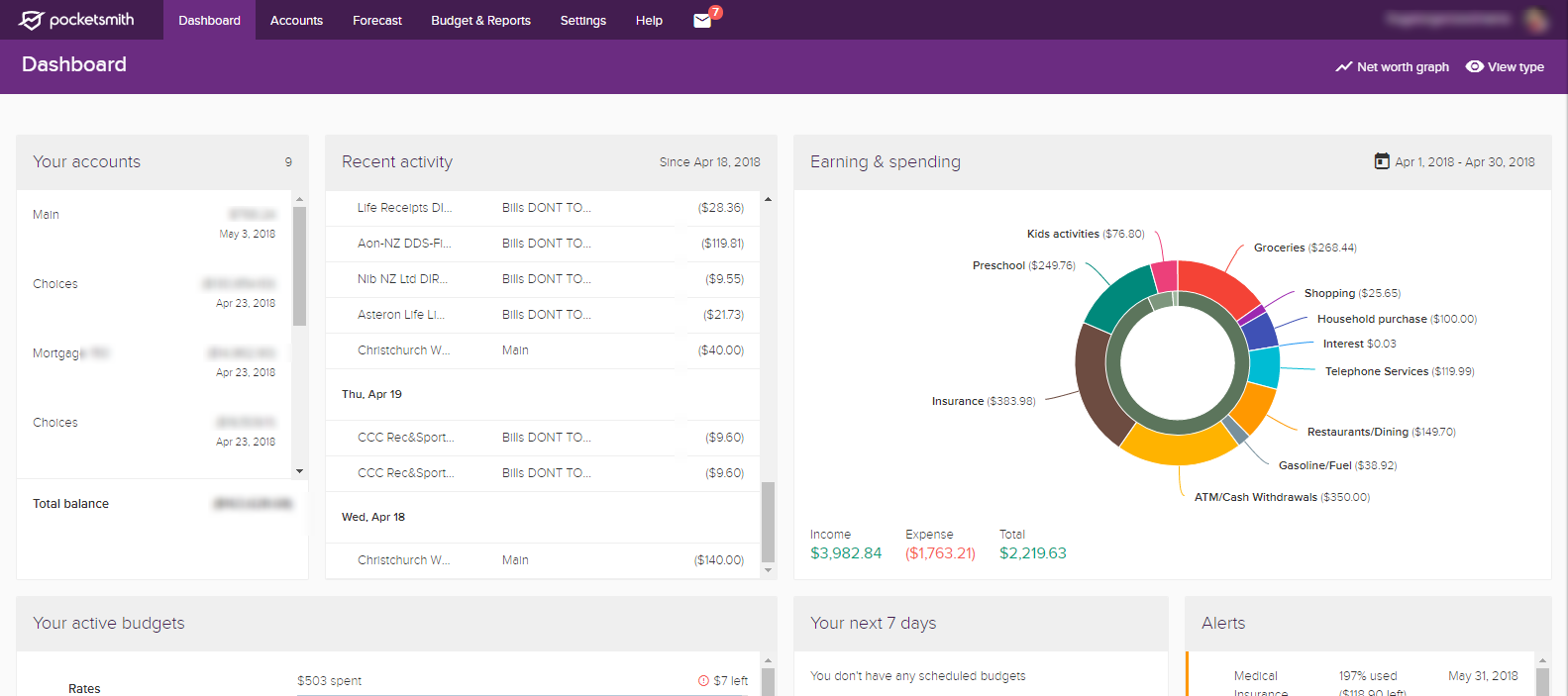

When it comes time to look at our budgets, some of us want detailed information, and some of us don't - PocketSmith is designed for those of us who want to know where our money is going. For those of us who want to see what would happen if we say, spent $20 less on takeaways a month, or $10 less on our phone bill, or a combination of these... or even something more ridiculous like renting a house half the size for a year or two.

But, first up, what actually is it? It's a tool that will:

- Draw in your bank transactions (either manually by you adding them, or automatically for a fee)

- Help you to categorise these transactions (and the categorising gets easier over time as it learns what you categorise things to)

- Helps to you set a budget - either based on your ideals, OR based on what you've been spending

- Alerts when when you exceed that budget, and shows you how much you have to go

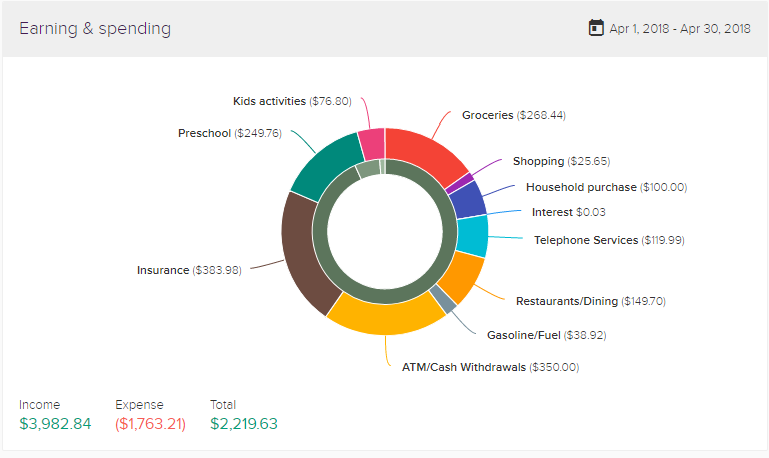

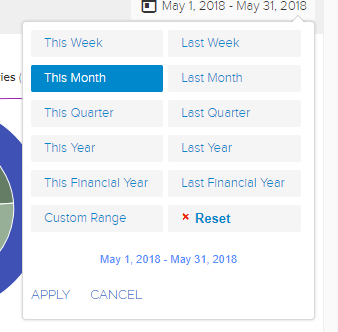

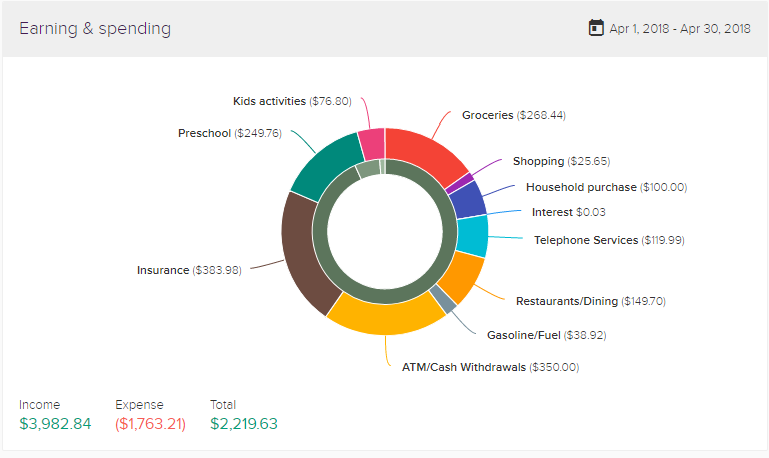

- Shows you how much you've spent on certain categories in a certain time-frame (of your choice)

Now that I've spent a month or so with it, I can see two ways that it could be used really effectively.

Want to join up to have a go at it already? You can see all the pricing and features of each plan (including the free one) here - * This is a referral link, it will cost you no extra to use the link, but will help support me to continue creating amazing resources for you

Number 1 - Way to use PocketSmith: Using it 100%

You could use it as efficiently as possible, going in every day or two, making solid, accurate budgets and ensuring you stick to what you want to do. This will take some trial and error - like any budgeting method - and would be really effective to manage your budget whether it was a strict one, or more relaxed. You can use it in conjunction with articles like this one on home heating to find ways to lower costs too

Number 2 - Way to use PocketSmith: Use it in retrospect as a reflection tool

This is the way I'll use it going forward. It can work well as a reminder of your goals and your actual spending behavior... Using it once every 1-2 weeks, you can go in and categorise those transactions. Then once categorised, you can check how much you spent on certain things this month, and how that compared to the present and the future.

Using Pocketsmith, I can see how much I spent on Takeaways last month and compare that to say the month before, or the year before. Using this longer term is an effective way to keep an eye on those increases... And - like in my case for Takeaways - revise things when you realize that you are spending too much in one category. Seeing the numbers of what you are spending in one area over a period longer than a week or a month can help give enough "Shock Factor" to give you that motivation to change things!!

Some things to be aware of to make the budgeting easier especially if you don't check them on a weekly basis - and this applies to anyone budgeting by looking back over transactions

- If you withdraw cash, note down what it was for - it's hard to remember 2 or 4 weeks later

- If you have a purchase from a shop you don't use as much (and might not recognise the name of the shop on your transaction list), note it down as well

- If you have a purchase that is split (i.e. you spent $60 on fuel and $10 on lunch in one transaction), note that down then split it. Or just keep your receipt in one spot for all these sorts of things so it's easy to work it out as you go through.

- And... I figured out that you can actually send reciepts to your PocketSmith account via email... Which helps for figuring out those tricky ones - or for keeping purchase receipts safe too.

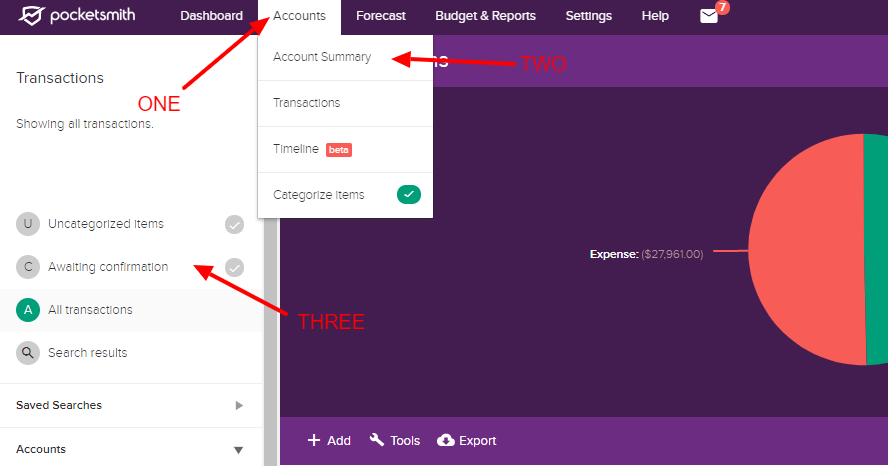

If you set it up to automatically sync bank transactions, it can be a little tricky to find your "transactions waiting confirmation" - This picture should help you with that!

I'm sure you are now thinking, what's the catch, whats the cost... It's about $10 a month if you want to automatically sync transactions, and free for two accounts without syncing.

More thoughts

There were a few things I found frustrating but PocketSmith have helped me figure them out. For instance, I couldn't find where to connect two bank accounts from the same bank - but it is easily done! I also found it frustrating seeing my full financial situation all the time. We have a mortgage and are in significant debt due to this but I don't want to see it all the time as it's not "consumer debt" and not a problem for me.

I suspect that classing the loan payments as "rent" and then manually tracking the amount we have paid off (and will pay off by certain dates) would be more motivating on a daily basis. The forecasting option CAN remove certain accounts though and this would be one way of getting around this and seeing the "daily" perspective. I am definitely working on this though so I can start reaching the daily/monthly/yearly goals more obviously.

Is it worth it? Would I recommend it?

Want to join up? You can see all the pricing and features of each plan (including the free one) here - * This is a referral link, it will cost you no extra to use the link, but will help support me to continue creating amazing resources for you 🙂 *